A: With PAY COUNTY TAXES, you can pay your bill online. Most customers find online payments are easier, faster, and more convenient than traditional bill payment methods. In addition, the ability to manage your account and payment information at your convenience means you can solve most problems without assistance from our Customer Service Department. We value our customers and are excited to provide you with an opportunity to save valuable time.

A: If you pay through a checking or savings account there is a $1.50 convenience fee. If you decide to pay by credit card, you will be charged a service fee. This service fee will equal 2.65% of your payment amount. For example, if your real estate tax bill is $100, your service fee (when paying by credit card) would equal $2.65.

A: You can pay your bill either by an automatic draft from your bank account, or by a credit card (VISA, MASTERCARD, DISCOVER, or AMERICAN EXPRESS). When you pay your bill, you specify which payment you would like to use.

A: No, only one bank account may be used.

A: No, only one credit card can be used for each transaction. No split payments.

A: Your credit card will be charged on the day that you pay your bill.

A: Checking and savings account payments generally take two to three days to clear the bank.

If you pay your bill by credit card it will clear the bank on the same day.

A: Yes. After you make a payment, a screen containing a payment reference number will appear. It is recommended that you print a copy of this confirmation screen for your records.

A: Yes. Starting from the time you enroll, PAY COUNTY TAXES retains a copy of your online payments.

A: Only payments made electronically through PAY COUNTY TAXES will be recorded and stored in PAY COUNTY TAXES.

A: No. Contact the Tax Department at 610-891-4278 or email them at realestatetax@co.delaware.pa.us

A: Thanks to the many safeguards now available for online financial restrictions, internet transactions can be even more secure than putting a bill payment in the mailbox or paying with a credit card at a restaurant. PAY COUNTY TAXES - Powered by Autoagent.com, uses state-of-the-art security, including secure socket layer (SSL) encryption and password protection to ensure the security of your transactions and personal information.

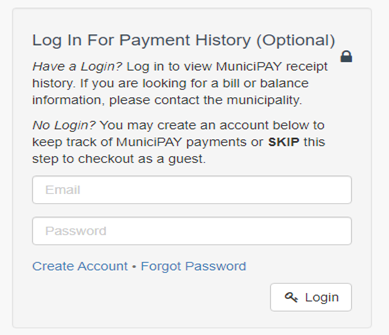

A: There are two options to pay online. Check out as a guest or create an account to keep track of your payment history.

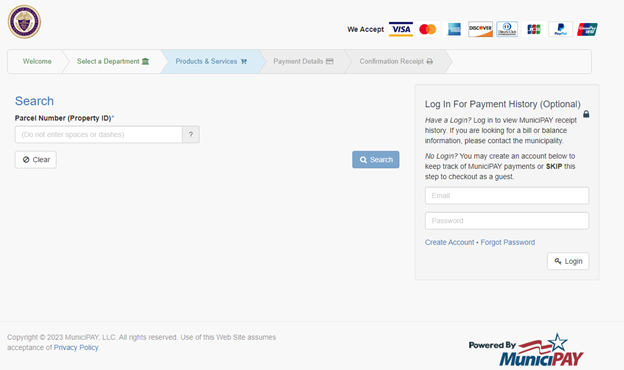

Check out as a guest: No Login required

Click on the link www.delcopa.gov. Click on “Public Access” at the top of our homepage. Once in Public Access, click on the “PAY COUNTY TAXES” icon. This will take you to the screen below. Enter your property ID Number listed on your tax bill. When entering your Property ID, no dashes or spaces should be entered. Select your property under search results and continue to process your payment. Please contact our Customer Service Department at 1-610-891-4278 for any assistance.

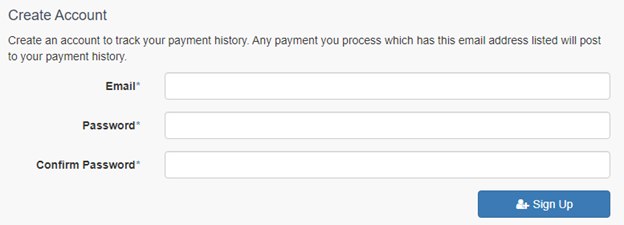

Create an account: This option allows you to view receipt history.

Click on the link www.delcopa.gov. Click on “Public Access” at the top of our homepage. Once in Public Access, click on the “PAY COUNTY TAXES” icon. Click on Create Account in the Log in For Payment History box. Follow the prompts to set up an account. Enter an email address and password. Then confirm your password and click the Sign-Up button. You will receive an activation email to engage. Please contact our Customer Service Department at 1-610-891-4278 for any assistance.